48th Semi-Annual Tax & Estate Planning Forum

By: Kevin F. Murphy

A. IMPACT OF FORM OF ENTITY ON EMPLOYEE BENEFITS

1. IRS Position with Respect to Owner/Employees

In 1969, the Internal Revenue Service released Revenue Ruling 69-184¹ in which the Service formally stated that bona fide members of a partnership are not employees for purposes of federal employment tax. Although the pronouncement addresses a situation involving a “true” service partner to the partnership, devoting “his time and energies in the conduct of the trade or business of the partnership,” the general informal position of the IRS is that workers that receive a partnership interest, regardless of how small an interest and regardless of their other “partner-like” responsibilities (i.e., managerial, decision-making authority, etc.), such an individual is to be treated as an independent contractor and not as an employee of the business.

Set forth below are a few of the differences that an LLC or partnership which gives equity interests to all or, some of its employees may have with respect to the administration of the above-referenced different forms of compensation arrangements.

2. Differences with Respect to Treatment of Wages

Although an employer is generally required to withhold income taxes and federal employment taxes from an employee’s wages, if an individual is treated as being self-employed, such individual’s wages are not subject to withholding. Instead, such individuals are required to pay estimated taxes². Similarly, whereas taxable wages for an employee are reportable each year on a form W-2 (or a Form 1099 for an independent contractor), taxable income is reportable on a Form K-1 for partners or members of a limited liability company.

¹ Rev. Rul. 69-184, 1969-1C.B. 256.

² I.R.C. § 6654.

3. Differences with Respect to Treatment of Retirement Benefits

Generally, the vast majority of the rules governing qualified retirement plans are the same for partnerships and LLCs as they are for businesses that are corporations. Nevertheless, as provided in the bullet-points below, a few significant differences do exist.

• LLCs and partnerships are prohibited from receiving tax deductions for contributions made on behalf of “self-employed” individuals to the extent such contributions exceed the earned income of the individual from the business sponsoring the retirement plan³ For purposes of determining the earned income of the individual, the contributions made to the qualified plan are disregarded.

• LLCs and partnerships who employ individuals who own an equity interest in such companies may also encounter problems in calculating the definitions of compensation for purposes of Section 415 and 414(s) of the Code.

• Previously, an “owner-employee” of a partnership or LLC, which is defined to include a partner or member who owns more than 10% of the capital profits interest in the partnership or LLC, is not exempt from the prohibited transaction rules in the Code and ERISA when receiving a plan loan from a qualified retirement plan. This law changed effective January 1, 2002. Thus, after such date, such owner-employees will be eligible to receive plan loans without the loans automatically being deemed to constitute a prohibited transaction.

• As ERISA only covers retirement plans that an employer sponsors for its employees⁴ retirement plans that cover only partners are not subject to ERISA. Presumably, the same treatment would apply to retirement plans that cover only LLC members. Thus, unless such a retirement plan contained an anti-alienation provision that was valid under state law or another non-bankruptcy law, a participant’s interest in his or her plan may be included as part of his or her bankruptcy estate.

³ I.R.C. 404(a)(8).

⁴ 29 CFR § 2510.3-3(b).

4. Differences with Respect to Treatment of Welfare Benefits

Like retirement plans, most welfare benefit arrangements provided by limited liability companies and partnerships are subject to the same tax laws and rules as welfare benefits provided by corporations. Nevertheless, a few differences LLCs and partnerships should be aware of are the following:

• Because Code sections 105 and 106 apply only to coverage of employees, self-employed individuals are required to include in their taxable income the value of any employer provided health care coverage. Likewise, self-employed individuals must include in gross income the value of any group term life insurance coverage they receive from their employer. Self-employed individuals are also prohibited from participating in a cafeteria plan as all participants in Section 125 cafeteria plans are required to be common-law employees⁵

⁵ I.R.C. §125(d)(1)(A).

5. Differences with Respect to Treatment of Equity-Based Compensation

From a legal standpoint, there are minimal differences between the rules governing equity-based compensation arrangements for corporations and such rules as they apply to partnerships and LLCs. The few differences are as follows:

• A potentially significant administrative and legal issue to deal with when discussing equity-based compensation alternatives with respect to partnerships and LLCs concerns how to treat the eventual transfer of the member or partnership interest to the employee. Potentially different tax consequences may result depending upon whether there was a transfer of a profits interest or a capital interest in the entity⁶ In addition, it is widely believed that partners’ or members’ assets and capital accounts in a partnership or LLC should be “booked-up” at the time the entity transfers either a profits interest or a capital interest. The book-up essentially enables both the service provider and the existing-owners of the entity to receive the economic deal that they anticipate, as well as prevent a situation in which a service provider expecting to receive a profits interest to be deemed for tax purposes as receiving a capital interest in the partnership or LLC.

• One advantage of, offering equity-based compensation, or any type of compensation arrangement for that matter, through an LLC or a partnership is that partnerships and LLCs are not subject to Section 162(m)’s $1 million dollar limit on deductible compensation⁷

• In addition to not being subject to Section 162(m)’s limitations, the golden parachute rules imposed under Section 280G and 4999 of the Code also do not generally apply to payments made by LLCs or partnerships.

• As mentioned above, one disadvantage of the LLC or a partnership is that incentive stock options are not generally available to be granted. Although some practitioners believe it may be possible for an LLC to sponsor an incentive stock option plan which qualified for the special tax treatment. There is no formal guidance from the IRS with respect to the issue.

⁶ For a good discussion on the underlying theories for taxation, see James W. Forsyth, Compensatory Transfers of Partnership interests, 42 Tax Mgmt. Memo 251 (June 4, 2001).

⁷ I.R.C. § 162(m)(1)

B. QUALIFIED PLAN SELECTION

1. Introduction

a. Essentially, there are two types of plans: defined contribution plans and defined benefit plans. A plan (whether a defined contribution or a defined benefit plan) will be tax-qualified only if the contributions or the benefits provided under the plan do not discriminate in favor of employees who are highly compensated.

i. Defined contribution plans are typically tested by examining how contributions, forfeitures, trust income and gains or losses are allocated to participants.

ii. Contributions and forfeitures allocated to highly compensated participants as a percentage of their compensation must not be appreciably higher than for non-highly compensated participants.

iii. Trust income, gains and losses, must generally be allocated to participants in proportion to their account balances.

b. A limited exception to discrimination in favor of highly compensated employees is allowed in plans that are “integrated” with social security.

i. The integration level used is the social security “taxable wage base” for each year (the maximum amount of compensation subject to social security taxes) or may, in certain circumstances, be a stated dollar amount which is less.

ii. The assumption is that the company’s plans and the company’s contribution to the social security system should be considered together, or “integrated” in testing for discrimination under the company’s plan.

c. Distributions from qualified retirement plans are subject to spousal protection requirements. Unless spousal consent is obtained, benefits must be paid in an annuity form such that the participant’s spouse is protected. A profit sharing plan may be exempted from this requirement provided that any death benefit under the plan is fully payable to the surviving spouse.

2. Defined Contribution Plan

a. Under a defined contribution plan, company contributions are usually made to a trust and invested as a whole, and separate bookkeeping accounts are maintained to record each participant’s share of the net worth of the trust.

i. At retirement, a participant is entitled only to the amount in his account, or to a pension or annuity that amount will supply.

ii. The amount in a participant’s account in turn depends upon how long he is a participant in the plan, his share of contributions made by the company, and the result of trust investments and forfeited accounts of other participants.

b. The term “defined contribution” may be somewhat misleading in that it implies that specified contributions must be made. Defined contribution plans include profit sharing plans, where contributions may be discretionary, and money purchase pension plans which call for a specified contribution.

c. How each participant’s share of plans assets is determined must be specified in the plan document. This requires the plan to specify:

i. How the company contributions are allocated among plan participants;

ii. How changes in plan assets are to be allocated, such as dividends, interest, realized gains or losses on sales of trust investments, and unrealized gain and losses in the value of trust investment;

iii. The percentage of a participant’s account which he cannot be deprived of even if he resigns or is discharged before retirement and the part which will then be lost or forfeited; and

iv. How forfeited accounts of participants who leave before retirement (“forfeitures”) are allocated among accounts of the remaining participants.

d. Allocations must be made at least once a year. Immediately after the allocation, the total of participants’ accounts will equal the net worth at market value of the trust holding the plan assets.

e. Under the garden variety defined contribution plan, contributions and forfeitures are allocated in proportion to the compensation of participants, and dividends, interest, realized and unrealized gains and losses are allocated in proportion to the account balances of each of the plan participants.

i. A defined contribution plan may also allocate contributions and forfeitures in proportion to units; for example, each participant may be assigned a certain number of units based on compensation, and additional units for years of service.

ii. Use of units in certain instances will be discriminatory and not permissible.

f. Another important governing rule for defined contribution plans is the concept of annual additions. This limits the amounts that may be allocated to a participant’s account in a particular year. There is no limit on dividends, other trust income, or on realized or unrealized gains which may be added to a participant’s account. Other items, which are limited, are given the term “annual additions” and consist principally of company contributions and forfeitures. If a plan requires or allows contribution by employees, these contributions also fall within the term annual additions. Beginning January 1, 2002, total annual additions allocated to a participant in any year under all defined contribution plans of a company may not exceed $40,000.

3. Profit Sharing Plan

a. Profit sharing plans often provide for contributions which are completely discretionary. Where the formula is discretionary, the board of directors must adopt a resolution setting the amount of the contribution. Once the resolution is adopted, the contribution may be made up to the time required for filing the corporation’s income tax return and any extensions of the time to file. The plan could lose its qualification if contributions are not substantial and recurring.

b. Some profit sharing plans require the company to contribute a specified percentage of profits each year. Complex formulas are sometimes used to determine what part of profits are to be contributed to the plan.

4. Money Purchase Pension Plan

a. Use of the term “defined contribution” may be more logical in the case of a money purchase pension plan. Under a money purchase pension plan, a company is required to make contributions specified in the plan document.

b. Although called a “pension plan”, the money purchase pension plan, just as the profit sharing plan, does not promise any specified pension.

i. Bookkeeping accounts are kept to record each participant’s share in the trust holding plan assets.

ii. At retirement, a participant receives whatever pension the balance in his account will purchase.

iii. The amount of the pension cannot be predicted because it depends upon the results of trust investments, the participant’s compensation, and how long the participant is in the plan.

5. Defined Benefit Plan

a. The distinguishing feature of a defined benefit plan is that a specified pension is promised. No separate bookkeeping accounts are maintained for participants, and company contributions are actuarially determined to provide payment of the promised pension.

b. A pension is defined or promised by one of several methods which consider service and compensation in varying degrees in setting the maximum pension payable by the particular plan.

i. A flat benefit plan provides that each participant receives a pension of the same amount. Neither years of service with the company nor compensation level has a bearing.

ii. A fixed benefit plan provides that a participant’s compensation level plays a part in determining the amount of his pension. However, service is not taken into account. For example, a plan provides an annual pension of 30 percent of average compensation.

iii. A unit benefit plan provides a pension which varies directly with both compensation and service. For example, a plan might provide an annual pension of 2 percent of average compensation for each year of service.

c. A defined benefit plan will not be discriminatory if anticipated pensions of highly compensated employees as a percentage of their compensation is approximately the same for the non-highly compensated employees. Because of this, substantial sums may be contributed to a defined benefit plan to fund pensions for older employees, including those who are highly compensated employees.

d. There is a limit on the annual pension payable under a defined benefit plan. A participant’s annual pension payable in the form of a straight life annuity is limited to the lesser of:

i. $90,000 per year (this limit is subject to increases for cost of living adjustments); or

ii. 100 percent of a participant’s average compensation, based on the average of his highest three consecutive years while a participant in the plan.

iii. Both of these limitations above, must be reduced pro rata if a participant has less than 10 years of either participation in the plan or service with the company.

6. Vesting

a. A participant’s accrued benefit must vest over a period of time, based on years of service with the company. The plan must include a vesting schedule which is at least as good as one of the two minimum vesting schedules required by law, i.e., 5 year vesting, or 3 to 7 years graded vesting.

i. Under 5 year vesting, sometimes referred to as “cliff vesting”, a participant must be fully vested once he has 5 years of service. No vesting at all is required prior to that time.

ii. The 3 to 7 year graded vesting schedule requires 20 percent vesting after 3 years of service, increasing by 20 percentage points each year for the next 4 years. A participant with 7 years of service will be 100 percent vested.

b. A company can, of course, be more generous and provide for vesting at a faster rate than prescribed in the minimum schedules above.

c. The plan must provide contingent vesting provisions in the event that it becomes “top heavy”. A plan is top heavy if 60 percent of the accrued benefits under that plan are allocated to the accounts of key employees.

i. A participant must be 100 vested once he reaches the plan’s normal retirement date (even if he has less than the years of service otherwise required for 100 percent vesting).

ii. A participant must also be 100 percent vested in any account pertaining to employee contributions (if any).

7. Integration with Social Security

a. Defined contribution plans are integrated by establishing an integration level or breakpoint, and by providing a higher contribution percentage for compensation above the integration level than for compensation below that level. The differential, or spread, between these rates cannot exceed certain limitations. The integration level cannot exceed the social security taxable wage base in effect at the beginning of the plan year.

b. The spread in both corporate and self-employed defined contribution plans is limited to the employer’s share of the OASDI tax.

c. Under the integration rules, the spread (permitted disparity) cannot, exceed the lesser or (1) the base contribution percentage, or (2) the greater of 5.7 percent or the portion of the OASDI rate that is attributable to old age insurance.

Example. A plan providing for contributions equal to 10 percent of compensation below the integration level will be permitted contributions of 15.7 percent of compensation above that level, whereas a plan providing for a contribution of only 2 percent of compensation below that level will be limited to a 4 percent contribution with respect to compensation above the integration level.

d. The integration level can be lower than the social security taxable wage base if the lower level will not discriminate in favor of highly compensated employees.

e. The defined benefit plan integration rules are extremely complex.

i. An excess defined benefit plan is integrated by establishing an integration level, and by providing a higher benefit percentage for compensation above the integration level than for compensation below that level. In general, the integration differential in an excess plan is limited to .75% for each year of the participant’s years of service with the employer (up to a maximum of 35 years of service).

ii. An offset defined benefit plan is integrated by reducing a participant’s benefit by a portion of the participant’s social security benefits. In general, the maximum offset is .75% of the participant’s final average compensation for each of the participant’s years of service (not to exceed 35 years of service).

8. Factors in Choosing a Plan

a. The following general principles should be considered in deciding between a defined benefit plan and a defined contribution plan.

i. Defined benefit plans require contributions necessary to fund promised pensions, without regard to a company profit. A company should not adopt such a plan unless it can afford to make the necessary contributions. A company subject to extreme fluctuations in profits and cash flow should probably avoid adopting a defined benefit plan.

ii. A defined benefit plan is subject to minimum funding standards in making pension plan contributions. If a plan is terminated and does not have sufficient assets to pay a minimum pension, the company may be liable to the PBGC.

b. If the intent is to obtain the largest possible pension for management and if management is older than most of the other employees, a defined benefit plan should seriously be considered. Similarly, if management is younger, a defined contribution may be more attractive.

c. A profit sharing plan is particularly useful where a company’s profits or cash flow is unpredictable. The greatest flexibility will exist where discretionary contributions may be made.

C. THE ECONOMIC GROWTH AND TAX RELIEF ACT OF 2001

Currently, the first and second largest tax expenditures for the United States government are attributable to the available exclusions from income of pension contributions and earnings and the exclusion of employer contributions for medical insurance premiums and medical care, respectively. For the 2000 fiscal year, the tax expenditures for these two items alone amounted to more than $162 billion in lost revenue. Given the magnitude of tax expenditures allocated to these employee benefit issues, tax laws associated with employee benefit issues are continually being changed by the government. Unfortunately, constant change in the employee benefit laws and regulations often can be a significant burden for small businesses sponsoring employee benefit plans. Despite having much fewer resources available than large employers to deal with such changes, small businesses are often subject to the same regulatory burden. An exhaustive list of all of the legislative changes applying to employee benefit plans is beyond the scope of this paper. Set forth below, however, is a summary of the employee benefit provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001.

Increased Contributions and Benefit Limits.

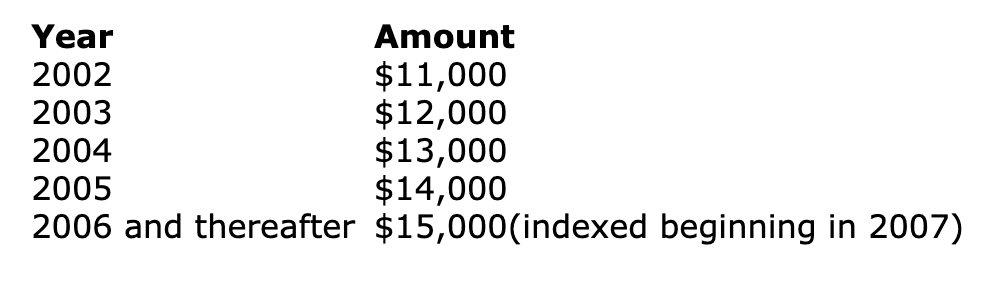

Workers who participate in an employer-sponsored, deferral-type retirement plan (such as 401(k), 403(b) and 457) can defer more of their pre-tax income, as follows:

The annual limit is increased to $40,000 in 2002 and indexed for future years. The corresponding percent of compensation limit is raised from 25% to 100%.

- Profit Sharing Plan Contribution/Deduction Limit

The employer annual deduction limit for profit sharing plans has been increased from 15% to 25% of eligible payroll.

- Defined Benefit Plan

The defined benefit plan annual benefit limit is increased to $160,000 for 2002 and indexed for future years.

- Compensation Limitation.

The limit on compensation that may be taken into account under a qualified plan for the purpose of determining contributions and benefits under Code Section 401(a)(17) is increased to $200,000 in 2002, and then indexed in $5,000 increments thereafter.

D. PLANNING FOR SMALL BUSINESSES

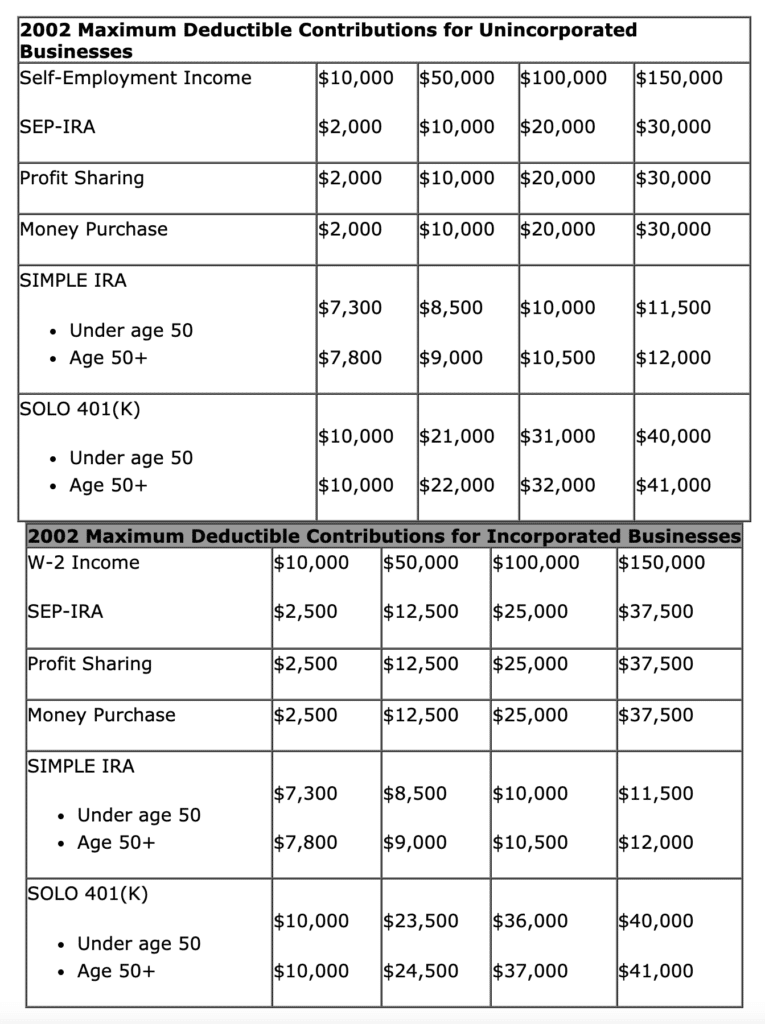

1. Solo 401(K) Plans

The Economic Growth and Tax Relief Reconciliation Act of 2001 encouraged the adoption of retirement plans by small employers with the enactment of the Solo 401(k) plan legislation. It is specifically targeted at any business that employs only owners and their spouses.

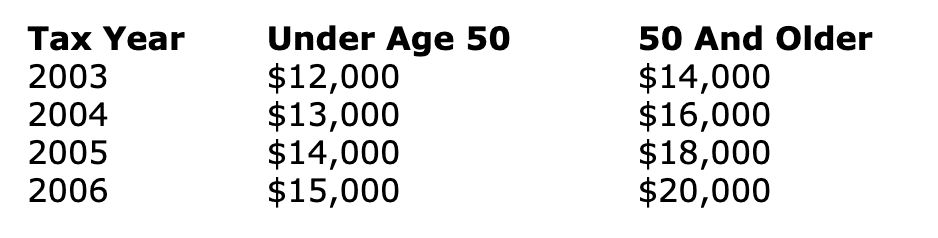

For an owner/employee, he or she can contribute up to 100% of the first $11,000 of his or her 2002 compensation or self-employment income ($12,000 if he or she is 50 or older at year-end). For 2003 and beyond, the numbers will rise as follows:

2. SEP IRAs

These are designed for small businesses. The maximum SEP contribution per participant is the lesser of 25% of compensation, subject to the $200,000 limitation, or $40,000. an employer must contribute the same percentage or amount for each eligible employee.

Vesting is immediate.

The advantage of this type of plan is that administration and tax filings are minimal.

3. SIMPLE IRAs

These are designed as low cost alternatives for small businesses to 401(k) plans. Plan participants, including an owner, can contribute up to $7,000 (in 2002) per year on a pre-tax basis into an individual SIMPLE IRA account.

Employers avoid the complex discrimination rules applicable to 401(k) plans. However, the employer must match dollar-per-dollar up to 3% of compensation for participating employees, or can contribute 2% for all eligible employees.

All employer contributions are immediately and 100% vested to the employee.